Online payment gateways are a crucial tool for businesses in today’s digital age. With the rise of e-commerce and the increasing use of mobile devices for online shopping, it’s more important than ever for businesses to offer a seamless online payment experience for their customers. Square and Stripe are two of the most popular payment gateways available, and both offer a range of features and pricing options that can help businesses of all sizes to accept online payments. In this article, we will take a closer look at the features, pricing, and ease of use of both Square and Stripe, to help businesses choose the payment gateway that’s right for them.

About Square

Square is a financial technology company that was founded in 2009. Square’s primary product is a mobile point-of-sale (POS) system that allows businesses to accept credit and debit card payments using a smartphone or tablet. Since its inception, Square has expanded its offerings to include a wide range of financial services and products, including online payment processing, business loans, payroll management, and more. Square is widely used by small and medium-sized businesses around the world, and its simple and user-friendly interface has made it a popular choice for business owners who want to accept payments quickly and easily. Square is headquartered in San Francisco, California, and has offices in several other locations around the world.

About Stripe

Stripe is a technology company that provides payment processing software and services to businesses of all sizes. Stripe’s platform enables businesses to accept payments from customers around the world, process subscription payments, and manage fraud prevention, among other features. Stripe’s easy-to-use interface and flexible pricing options have made it a popular choice among businesses that want to accept payments online. In addition to payment processing, Stripe offers a variety of tools and services, including invoicing, mobile payments, and support for multiple currencies. Stripe is headquartered in San Francisco, California, and has offices in several other locations around the world. The company has received several awards for its innovative technology and approach to payments, and it continues to be a leading player in the fintech industry.

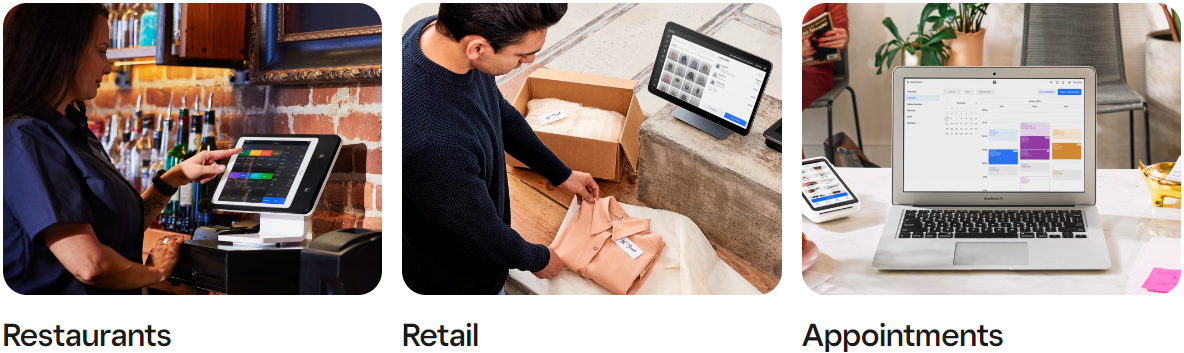

Square vs Stripe: Products & Services

Square offers a range of financial services and products beyond just payment processing, including online invoicing, payroll management, and business loans. Square also offers a range of hardware options, including a mobile card reader and a countertop POS system, that allow businesses to accept payments in person.

Stripe, on the other hand, is primarily focused on payment processing and offers a range of features to help businesses manage payments, subscriptions, and fraud prevention. Stripe’s platform also offers support for multiple currencies, which makes it a popular choice for businesses that operate in multiple countries.

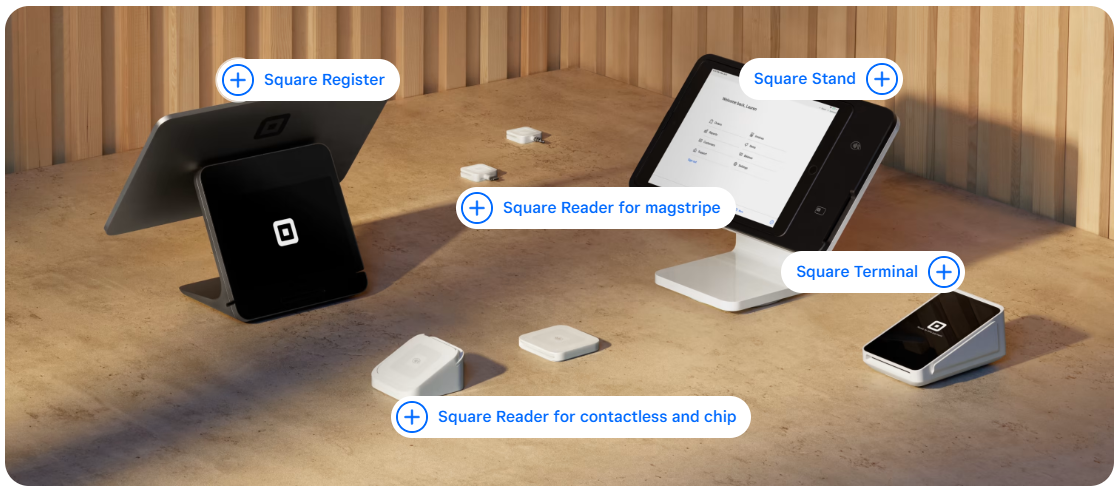

Square vs Stripe: Range of Devices

While Square offers a range of hardware options such as card readers and terminals, Stripe does not currently offer any hardware. Square’s hardware options are designed to work seamlessly with their payment processing software, making it easy for businesses to accept in-person payments. Square’s hardware options include the Square Reader, Square Stand, and Square Terminal, among others.

Stripe, on the other hand, focuses primarily on their online payment processing software and developer tools. While they do not offer any hardware options, they do provide support for businesses to integrate their payment processing into other hardware systems through their APIs and developer tools.

Square vs Stripe: Pricing

Square charges a flat fee of 2.9% + 30 cents per transaction for online payments, which is the same fee for all types of credit and debit cards. For in-person payments using a Square card reader, the fee is 2.6% + 10 cents per transaction. Square also offers a range of hardware options, such as the Square Reader and the Square Stand, which have different pricing plans.

Stripe’s fees vary depending on the type of transaction. For online payments, the fee is typically 2.9% + 30 cents per transaction, which is similar to Square’s fee. However, Stripe offers a lower fee of 2.2% + 30 cents for businesses that process more than $1 million in payments per year. For in-person payments using a Stripe card reader, the fee is 2.7% + 5 cents per transaction.

Square vs Stripe: Ease of Use

Square’s platform is designed to be user-friendly and easy to navigate, with simple interfaces for managing payments, invoicing, and other financial tasks. The Square card reader is also simple to use and can be set up quickly for businesses that need to accept in-person payments.

Stripe’s platform is similarly easy to use and offers a range of features to help businesses manage payments, subscriptions, and fraud prevention. Stripe’s user interface is well-designed and intuitive, making it easy for businesses to manage their payments without needing extensive technical expertise.

Overall, both Square and Stripe are designed to be easy to use and require little technical expertise to get started. However, the choice between the two may depend on the specific needs of a business, including the level of customization and integration required.

Square vs Stripe: Help & Support

Square offers phone support during business hours, as well as email and online chat support. Square also has an extensive online help center that includes guides, FAQs, and video tutorials to help users troubleshoot common issues. Stripe also offers phone and email support, but does not have an online chat feature. However, Stripe does have an extensive online knowledge base with guides and documentation on how to use their platform.

Overall, both Square and Stripe offer reliable customer support through a range of channels. However, the choice between the two may depend on the specific needs of a business, including the level of technical expertise required and the importance of having access to online chat support.

Final Thoughts

Both Square and Stripe offer easy-to-use platforms for businesses to manage their payments, and both services offer customer support through a range of channels. Square has an online help center with video tutorials, while Stripe provides more extensive documentation and support for developers. Ultimately, the choice between Square and Stripe may depend on the specific needs of a business, including whether or not they require hardware options for in-person payments, as well as the level of customization and integration required. Businesses should consider the pricing, ease of use, and customer support options of both services before making a decision.